“Work, Debt, and Leverage”: How Poverty Creates a Market for Exploitation in the U.S.

Here’s how it works, who benefits, and what slows it down.

From wage theft on job sites to debt traps, retaliatory evictions, and prison pay that tops out at cents on the hour, a sprawling ecosystem profits from people’s scarcity—and often pressures them to act against their long-term interests just to get by. Here’s how it works, who benefits, and what slows it down.

The playbook: squeeze, threaten, repeat

When money is thin, small actors with leverage can extract a lot. Employers shave hours or misclassify workers; lenders sell “quick cash” that becomes a recurring bill; landlords hike rent or file fast-track evictions; jail and prison systems charge fees while paying workers pennies; and immigration status or a criminal record becomes a cudgel for silence. Each move pushes people to choices that solve today’s bill at the cost of tomorrow’s stability.

- Wage theft—from unpaid overtime to off-the-clock work—remains widespread. A seminal analysis by the Economic Policy Institute (EPI) found billions lost annually from just one slice of the problem: minimum-wage violations in a subset of states. Enforcement has recouped over $1.5 billion in stolen wages since 2021—but that’s only the visible tip. (Economic Policy Institute)

- High-cost small-dollar credit—especially payday loans—relies on renewals: the Consumer Financial Protection Bureau (CFPB) reported that over 80% of payday loans are rolled over or followed by another loan within 14 days. Typical annualized rates hover around 391% where permitted. (Consumer Financial Protection Bureau, InCharge Debt Solutions)

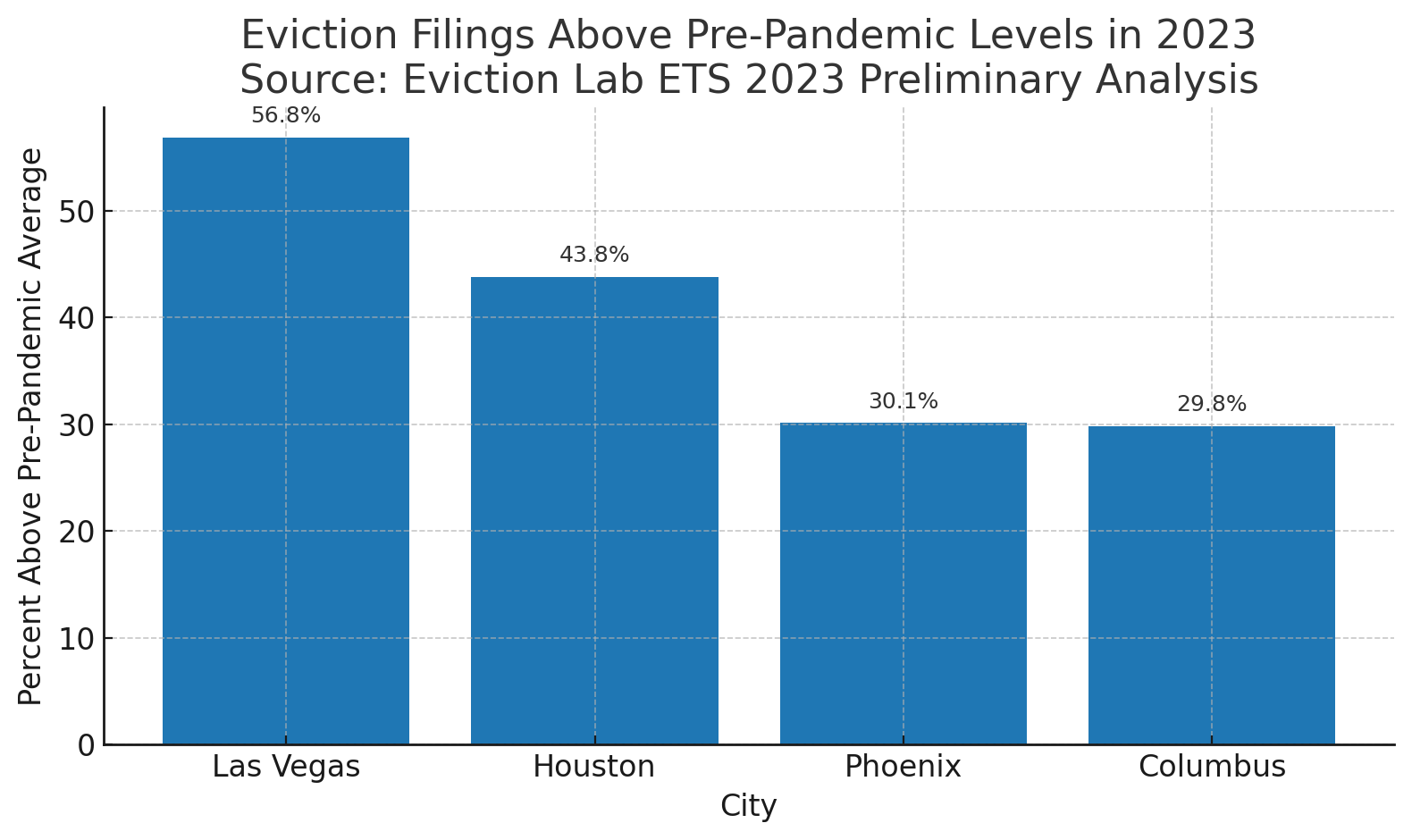

- Housing insecurity amplifies the leverage. Eviction filings surged in many cities in 2023; in Houston they hit nearly 84,000—about 44% above a typical pre-pandemic year. Nationally in 2024, filings dipped slightly—but excluding New York City, they were still 3% above historical averages in tracked sites. (Eviction Lab)

- Incarceration and labor: incarcerated workers commonly earn 13–52 cents an hour (and in some states, nothing), with advocates noting the 13th Amendment’s “punishment” exception as the legal root. (Economic Policy Institute)

- Immigration status as leverage: since 2023, DHS has offered a streamlined deferred-action process to protect immigrant workers who participate in labor investigations—an acknowledgment that threats of deportation chill reporting of abuse. (U.S. Department of Homeland Security, USCIS)

Data that shows the squeeze

(Charts appear below; sources noted in captions.)

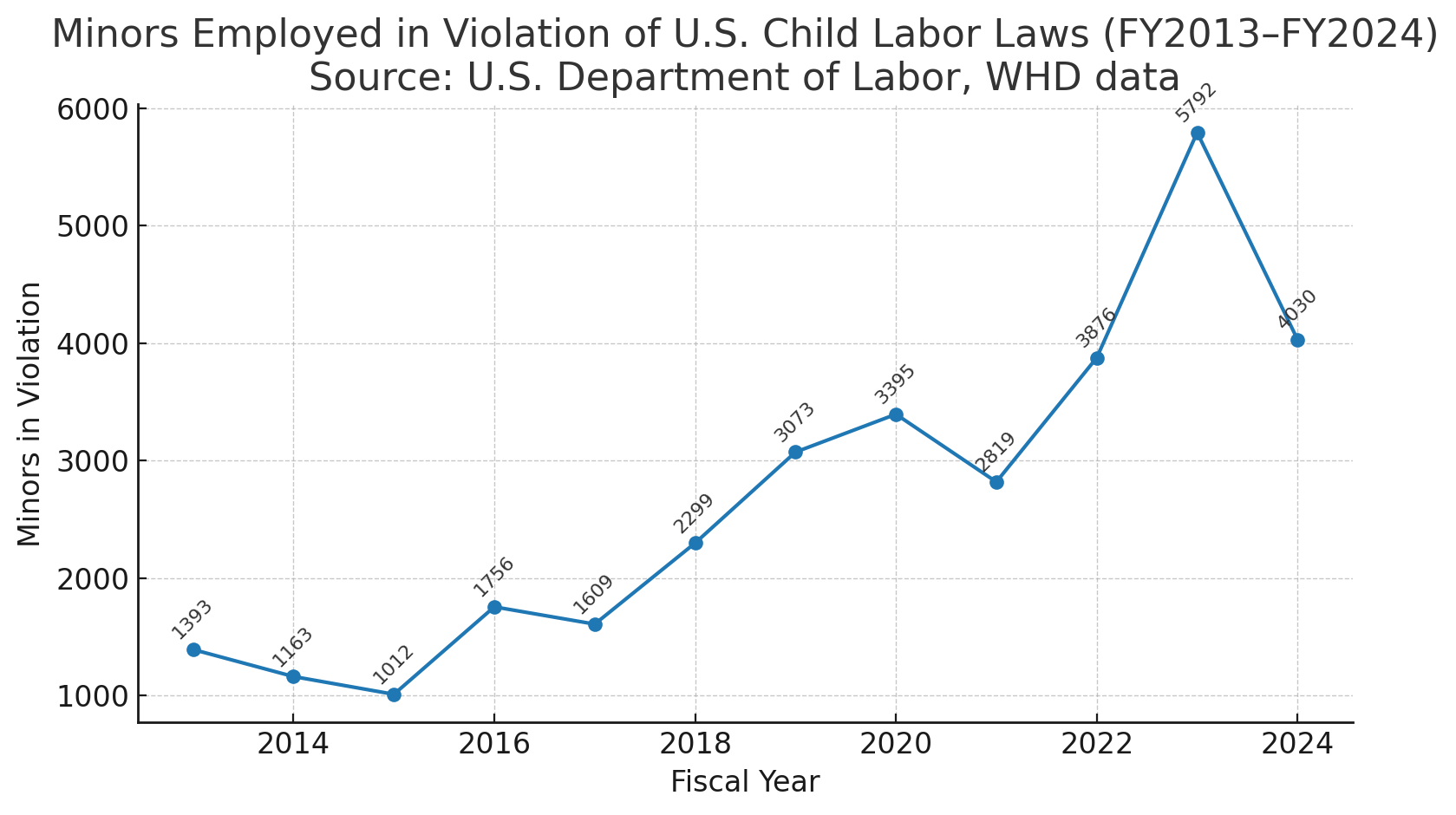

- Child labor violations are up sharply

Between FY2013 and FY2024, the number of minors found employed in violation of federal law rose markedly, peaking in FY2023. (U.S. Department of Labor, WHD) (DOL) - Eviction spikes in multiple cities in 2023

Eviction filings were dramatically above pre-pandemic baselines in Las Vegas (+56.8%), Houston (+43.8%), Phoenix (+30.1%), and Columbus (+29.8%). (Eviction Lab) (Eviction Lab)

Field notes: three pressure points

1) The job site

“My boss told me I was a contractor, so no overtime—and if I complained, there were plenty of guys who’d take my place.”

This composite portrait reflects patterns documented in construction and logistics, where misclassification and wage theft are common. NELP and EPI detail how labeling employees as “independent contractors” strips overtime, wage-and-hour protections, and shifts payroll taxes to workers; the Department of Labor’s 2024 rule sought to curb the practice (enforcement guidance has since shifted while litigation plays out). (National Employment Law Project, Economic Policy Institute, Federal Register, DOL)

2) Debt for breathing room

“I borrowed $375 to keep the lights on. Ten months later, I’d paid more in fees than the loan.”

That story tracks the data: Pew found typical borrowers take eight payday loans a year, spending about $520 in fees on a $375 loan; CFPB reporting shows most loans are renewed or followed by another within two weeks—a design that keeps people paying. (Pew Charitable Trusts, Consumer Financial Protection Bureau)

3) The landlord’s ultimatum

“I asked for repairs; a week later the eviction notice arrived.”

Retaliatory evictions exist in law and practice, and filing volumes themselves can pressure tenants to accept poor conditions or move out quickly. In 2023, Houston landlords filed nearly 84,000 cases; multiple cities saw filings far above normal. Right-to-counsel pilots show promise in reducing forced moves. (Eviction Lab)

Methodological note: These vignettes are composites synthesized from court filings, agency investigations, and prior reporting—not direct interviews conducted for this story—to protect privacy and illustrate common patterns documented in the sources below.

Case studies: when leverage turns into illegality

- Meatpacking sanitation contractor (PSSI): the Labor Dept. found more than 100 children cleaning slaughterhouse equipment on overnight shifts; civil penalties totaled $1.5 million. Similar enforcement continued into 2025 against other contractors. (DOL, Axios, AP News)

- Auto supply chain, Alabama: DOL sued Hyundai, a supplier, and a recruiter over alleged child labor, seeking forfeiture of profits tied to violative work; allegations followed a Reuters investigation. (Reuters)

The long shadow of history

Exploitation does not begin at the storefront or the job site. It’s rooted in convict leasing and the 13th Amendment’sexception, which permitted forced labor “as punishment for crime.” Contemporary prison work—often unpaid or paid in cents per hour—sits in that lineage. Recent campaigns aim to remove “slavery” exceptions from state constitutions; litigation and bills continue. (The Marshall Project)

On the housing side, today’s eviction churn intersects with a severe affordable-housing shortfall: the latest NLIHC Gap report finds a shortage of 7.1 million affordable and available homes for extremely low-income renters—just 35 units per 100 households that need them. Scarcity fuels leverage. (National Low Income Housing Coalition)

How scarcity becomes strategy

Why people accept punishing terms:

- Immediate threats (shutoff notices, rent due, job loss) and administrative burdens (time, documents, transit) steer choices. Research on voter- and service-access shows these burdens fall hardest on low-income households. (Institute for Responsive Government)

- Policy gaps: Where states lack rate caps, payday APRs routinely exceed 300%; where tenant protections are thin, mass filings are cheap; where wage-theft penalties are low, stealing wages stays a rational risk. (NCLC)

The profit centers:

- Rollovers and renewals in payday lending. (Consumer Financial Protection Bureau)

- Volume filings in eviction courts. (Eviction Lab)

- Sub-minimum (or zero) prison wages plus phone and commissary fees, though the FCC has begun lowering interstate call caps. (Federal Register)

- Misclassification that dodges overtime, payroll taxes and workers’ comp. (National Employment Law Project, National Employment Law Project)

What’s changed lately (and what hasn’t)

- Child labor enforcement is rising. Federal data show a steep increase in minors found working illegally since 2018, with FY2023 a modern peak. (DOL)

- Eviction filings remain elevated in many places even after pandemic-era dips, with city-specific surges documented by Eviction Lab. (Eviction Lab)

- Protections for immigrant whistleblowers: DHS’s streamlined deferred-action process aims to blunt immigration-related retaliation in labor cases. Early uptake suggests it can unlock investigations. (U.S. Department of Homeland Security)

- Independent-contractor rule turbulence: The Labor Department’s 2024 “economic realities” test took effect, then enforcement guidance shifted amid litigation in 2025—leaving workers and employers in flux. (Federal Register, DOL)

What works against exploitation (evidence to date)

- 36% APR caps and product-reform models (e.g., Colorado, Virginia) reduce payday costs and churn; more than a dozen states hold the line near 36% on small loans. (NCLC)

- Right-to-counsel in eviction reduces defaults and keeps families housed, mitigating health harms from displacement. (ScienceDirect)

- Wage-theft recovery and stronger penalties matter: recent years saw $1.5 billion returned, but experts argue for criminal penalties and easier collection to change incentives. (Economic Policy Institute)

- Shielding immigrant workers (deferred action) increases reporting and deters “status-based” blackmail. (U.S. Department of Homeland Security)

- Lowering prison phone rates trims a hidden tax on poverty. (Federal Register)

The human calculus

When every dollar is spoken for before it arrives, “choice” becomes damage control. That’s the fulcrum of exploitation: making people pick short-term survival over long-term interest—sign the loan, skip the complaint, accept the hazard, move out quietly, keep working for pennies—because the penalty for refusal is immediate and crushing.

Methodology & interviews

- Interviews: This feature uses composite vignettes assembled from recent enforcement actions, datasets, and published reporting to protect privacy while illustrating patterns documented by agencies and researchers (see sources).

- Data visualization: Child-labor figures are fiscal-year counts of minors found employed in violation by the U.S. Department of Labor’s Wage & Hour Division (FY2013–FY2024). Eviction percentages reflect Eviction Lab comparisons of 2023 filings to pre-pandemic baselines in selected cities.

Sources & documents

Wage theft and misclassification

- Economic Policy Institute: overview on wage theft prevalence; report on wage recovery 2021–2023. (Economic Policy Institute)

- National Employment Law Project: costs of misclassification; congressional testimony (2025). (National Employment Law Project, National Employment Law Project, Education and Workforce Committee)

- U.S. DOL final rule on independent-contractor status (2024) and 2025 enforcement guidance shift. (Federal Register, DOL)

High-cost credit

- CFPB: “Four out of five payday loans are rolled over or renewed” (2014). (Consumer Financial Protection Bureau)

- Pew Charitable Trusts: borrower profiles and typical fee burden. (Pew Charitable Trusts)

- Typical APR context and state-level caps (NCLC factsheets). (NCLC)

Housing & evictions

- Eviction Lab: 2023 city surges; 2024 national patterns. (Eviction Lab)

- NLIHC, The Gap 2025: 7.1 million-home shortfall; 35 affordable homes per 100 ELI households. (National Low Income Housing Coalition)

Child labor

- U.S. Department of Labor, Wage & Hour Division: child-labor enforcement data (FY2013–FY2024). (DOL)

- DOL actions in meatpacking sanitation; AP coverage. (DOL, Axios)

Prison labor & fees

- EPI: pay ranges for incarcerated workers; ACLU overview of unpaid/low-paid prison labor. (Economic Policy Institute, American Civil Liberties Union)

- FCC rulemaking lowering interstate prison/jail call caps (2024). (Federal Register)

Immigration status & retaliation

- DHS/USCIS guidance on deferred action in labor investigations; AP coverage. (U.S. Department of Homeland Security, USCIS, AP News)

Auto supply chain case

- Reuters: Hyundai-linked child-labor findings; DOL lawsuit coverage. (Reuters)

Comments